In portfolio management, there are misperceptions everywhere. One of the most notable areas is between a portfolio manager and the end client. Most portfolio managers look at their portfolio and say, “Yup, that is exactly how we should be positioned.” Allocations are aligned with your macro view, diversification is strong, and the portfolio is set up for any environment.

Yet some clients can walk out of meetings feeling slightly confused. Not because the portfolio is wrong or the numbers are terrible, but because the story didn’t quite connect. It’s the gap between reality and perception. A good portfolio paired with a bad narrative can erode trust faster than a drawdown.

There are a few reasons why this might happen, the first being timing. Portfolios are designed to anticipate what’s going to happen next, while clients are usually focused on the latest headline from the past. Say you reduce U.S. equities and add international because valuations are stretched, and you believe a cycle is turning. A month later, the S&P 500 rips higher, international lags, and clients think the mark was missed. Seeds were being planted for next season, but the client is still focused on this one.

The second reason comes down to translation. Portfolio managers often speak in tilts, factors, and Sharpe ratios. Clients speak in goals, security, and outcomes. The language doesn’t always match up. Saying you added duration risk or trimmed high yield sounds perfectly rational to your peers, but it doesn’t land emotionally with most clients. Managers still need to find a way to show the portfolio is being actively managed without relying on industry jargon that doesn’t resonate with clients. They want to know what it means for them.

Finally, there’s a temptation to fill that gap with predictions. They sound confident, but now the focus shifts to judging on a trade call instead of a process. The opposite end of that spectrum is being vague. That can feel aimless; there’s no thesis at all. Both versions come up short. The middle ground is framing the positioning as prepared for a range of outcomes, but with a slight lean toward what we believe is most likely, not an all-in bet.

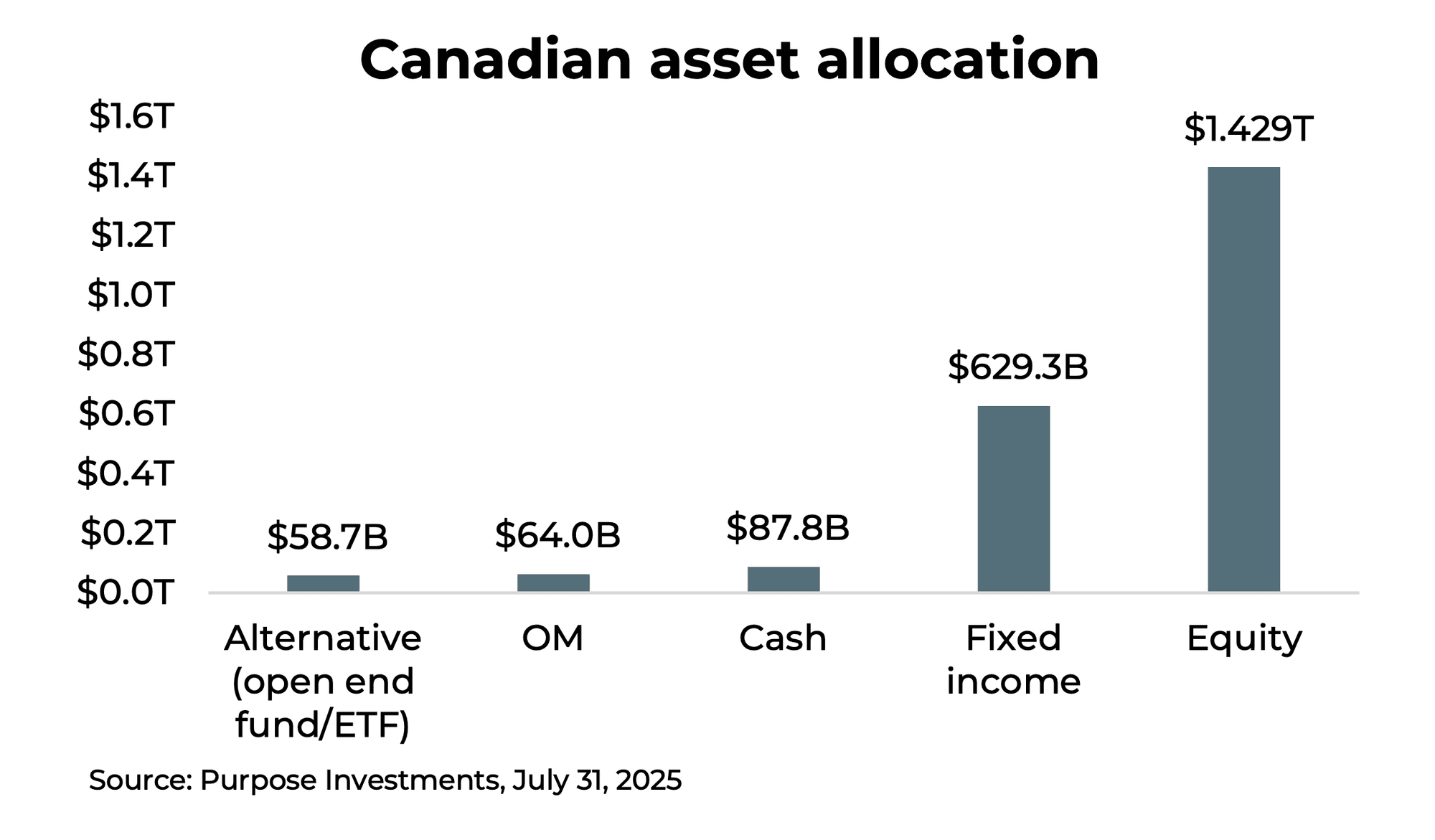

Keeping it simple remains one of the most important components of portfolio management. As proof that simplicity still sells, at the overall Canadian asset allocation. This is the total AUM by category in the Canadian investment landscape. Marketing might make it seem like alternatives are booming, but clients still prefer what they know and can understand. A broad equity or bond fund is easy to grasp, but a multi-strategy alt requires a story that most won't follow. Alts may add value to a portfolio, but adding them to your story can complicate things.

A good way to keep things simple is by thinking about the client perception risk and having a simple narrative ready for explanation. This is not the same as dumbing things down; it is simply putting it into terms that might connect. A defensive posture can feel like you’re lagging peers, or more cash can make it seem like you’re sitting on the sidelines. Anticipating those reactions or thoughts and preparing the narrative in advance is just as important as portfolio design itself.

Below are a few pairings that could help in the story:

The real job of a portfolio manager is twofold: to manage the portfolio and manage the narrative. This means focusing on the why, even when nothing is changing. Clients forget, and in fact, consistency is part of the story itself. If the commentary, review meeting, and follow-up all echo the same rationale, the message will have a better chance of sticking. If there’s a crack, clients fill the gap with their own, and it’s usually not the one you would want.

The irony is that most portfolio moves are often invisible. If cash was raised before a downturn or there was a shift away from a crowded trade, clients won't often know, or they might forget. Invisible positioning doesn’t get much credit; it’s on the manager to show their worth in a way clients will remember.

The key is to bring those invisible moves into the conversation in a way that shows preparation, not pessimism. It’s also important not to spike the football when something goes well. The danger of “I told you so” is that it sets the wrong expectation for the next call. Every win should be used to reinforce the process, not the prediction.

In the end, clients don’t buy asset mixes; they buy the relationship and what that does for their future. The market will always create noise. The goal is not to ignore the noise, but to help clients understand it and how you are managing through it. Anchor allocations to outcomes, translate complexity into language, and repeat why until it sticks.

At Purpose, one of our core principles is our transparent positioning and process. It’s a little easier for us; we don’t have to sit across the table from many end clients. But that makes it even more important that we give portfolio managers the full story in a way that can be shared with clients. That even means being upfront and honest, even when things don’t work in our favour.

It’s not always sunshine and rainbows, but we hope by showing both sides, portfolio managers can be even more prepared for discussions.

Final Thoughts

Portfolio storytelling is a tricky thing; even two portfolios with the same performance can be perceived differently. One portfolio framed as lagging peers might feel disappointing. But if the story is around process, the same returns can be shown as resilience during a period of volatility.

Closing the gap between reality and perception is what sustains trust, and trust is what ultimately keeps clients invested in both the portfolio and the process.

— Brett Gustafson is an Associate Portfolio Manager at Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only, and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold, or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees, and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements ("FLS") are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as "may," "will," "should," "could," "expect," "anticipate," intend," "plan," "believe," "estimate" or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.